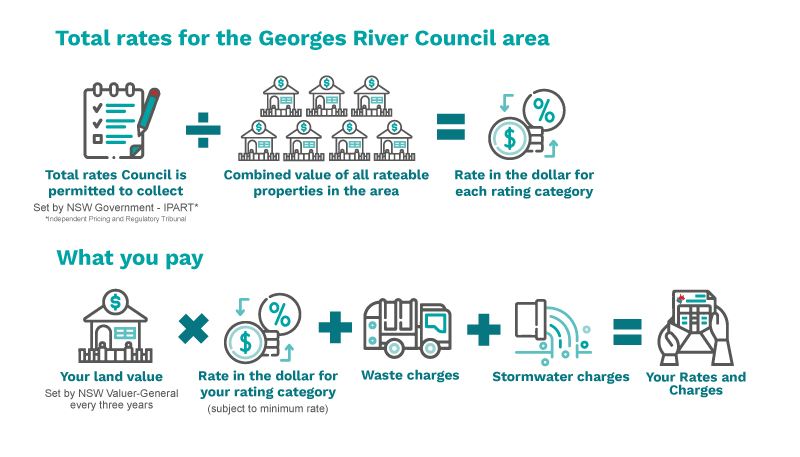

Calculating Rates and Charges

The are two types of charges listed on your Rates and Charges Notice.

Rates

Calculated based on the land value of your property issued by the NSW Valuer-General, except for low valued properties which are subject to a minimum rate amount. This is to ensure each ratepayer contributes a fair share towards the community services provided by Council. The total amount of rates Council collects from ratepayers is restricted (capped) by the NSW Government.

-

House owners generally pay much higher council rates than strata title property (e.g, apartment, townhouse) owners because the land values for houses are generally higher.

-

Apartment/townhouse owners are either charged the minimum rate or the rate based their portion of the complex, or a combination of the two. (For strata title properties, each strata lot is allocated units of entitlement which determine an owner's portion of the total land value). Councils set minimum rates amounts each year to reduce the gap between what houses and apartments/townhouses pay in their council area, on the basis that all ratepayers should be making a fair and reasonable contribution to cost of services.

Service Charges (waste and stormwater)

Supplier costs for disposal of waste have increased in recent years. Council can no longer absorb the increasing costs and, for the first time in 3 years, the standard domestic waste charge for 2023/24 has increased from $474 to $511 annually. Stormwater charges remain the same.

You can view our video on how rates are calculated below.

Overview - Our Area

Residential population: 153,055.

Georges River 2023 rates per person (total rates collected ÷ population): $455.

NSW average rates per person: $590.

Rate and Charges Structure for 2023/2024

|

Type

|

Minimum

|

Rate in the dollar*

(Ad-valorem)

|

| ^Residential - Ordinary |

$1,047 |

$0.0011298 |

| ^Business General - Ordinary |

$1,193 |

$0.0026168 |

| ^Business Industrial - Ordinary |

$1,193 |

$0.0032111 |

| ^Business Local - Ordinary |

$1,193 |

$0.0035193 |

| ^Business Major Shopping Complex - Ordinary |

$1,627 |

$0.0111165 |

| Business Strategic Centres - Ordinary |

$1,627 |

$0.0035903 |

| Domestic Waste Annual Service Charge |

$511 |

| Stormwater Management Charge |

Residential property:

- Non-strata $25

- Strata $12.50

Non-residential property:

- Non-strata $25 for every 350 square metres or part thereof to a maximum of $1,500 per rateable property.

- Strata not less than $5 for any individual lot.

|

*Applicable to land values issued by NSW Valuer-General.

^Rating category. For more information, visit Council's Land Values and Rating Categories page.

For additional information, please refer to the Office of Local Government Frequently Asked Questions – Rates and Charges page.

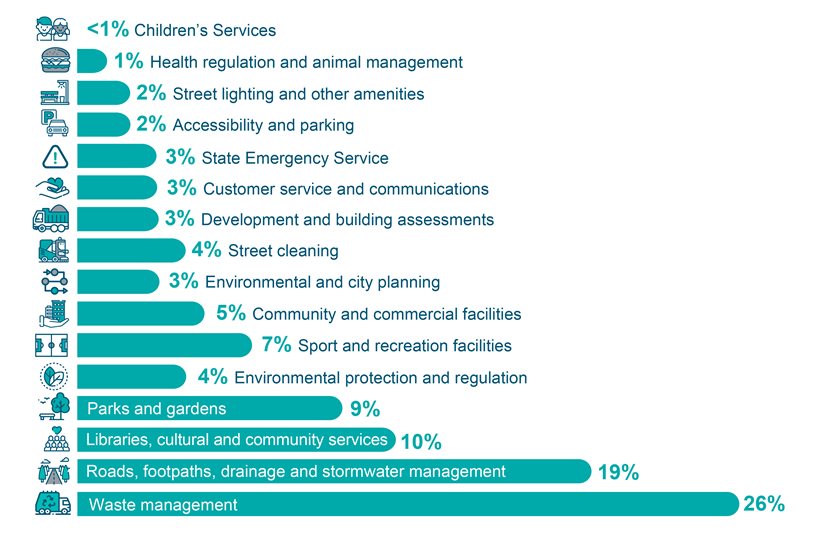

Your rates working for you

Rates collected by Council are invested back into the community through the delivery of services. These services include:

How rates are calculated - Frequently Asked Questions

-

How are rates higher or lower for the surrounding properties?

Properties with a higher land value contribute more rates, and vice versa. The NSW Valuer-General valued all land on 1 July 2022, so suburbs may have been at different points in the property market on that date, which can lead to differences in valuations, even for neighbouring suburbs.

- A big increase in land valuation since the last valuation could indicate a lift in the property market in your suburb; or that your property was at the low part of the market at the last valuation and has now caught up with the market.

- A small increase in land valuation could indicate a flat property market for your suburb or that your property was at the high part of the market at the last valuation, with only a small increase, as other suburbs catch up with the market.

For more information, visit the Land valuations and rating categories page.

-

How does Council decide how much the community pays for Rates and Charges?

Each Council is required to determine the combination of rates, charges, fees and pricing policies needed to fund the services it provides to the community. This is called a Revenue Policy (available within the Delivery Program and Operational Plan).

The Revenue Policy contains a rating structure that determines the rates and charges and how they will be calculated.

Charges are generally determined on an annual basis (1 July to 30 June the following year).

-

How does the rate peg affect rates?

The increase in total rates collected each year is restricted by State Government through the Independent Pricing and Regulatory Tribunal (IPART). IPART sets a maximum percentage increase for NSW Councils (either a rate peg or Special Rate Variation "SRV"), to keep up with inflation and other considerations.

For details about how the rate peg is calculated visit IPART's website.

The rate peg / SRV:

-

Does not apply to stormwater or waste collection charges.

-

Applies to Council’s total rates collected, and not to each individual property rates. Therefore, rates for an individual property may increase above this percentage, in particular if there are new valuations or if Council is required to catch up in rates not collected for previous years due to valuation objections.

IPART has set a 2023-24 rate peg for each council, ranging from 3.7% to 6.8%. Georges River Council has applied 5.8% SRV to the total rates collected in 2023/24, as approved by IPART (third year of a five year SRV), which enables us to continue to provide ongoing services for the community.

Although this increases the total rates collected by 5.8%, the change in rates for each individual property depends on how the land values for all properties have changed in the Georges River Council area.

-

How are increases to waste management and stormwater charges controlled?

Charges for domestic waste management services and stormwater are not subject to rate pegging.

- Waste management charges: Council's waste management charges need to reflect the cost in providing waste services and education to the community, and does not exceed the reasonable cost of providing the service.

- Stormwater charges: The maximum annual charge is regulated by Section 510A LG Act and Section 125AA under the Local Government (General) Regulation 2021.

Councils are still required to provide details in their draft operational plan and related draft revenue policy of what they are proposing to charge. Councils must consider submissions from the public before adopting the proposed rates and charges.

Share your thoughts and ideas on Council projects and activities on the Your Say Panel.

Thank you for your feedback.